DON’T SELL THE HOME TO PAY FOR AGED CARE!!

FIND OUT !!

How do Singles save up to $43,450 year in aged care fees AND Couples save $43,450 a year each

without selling the family home ?

Contact Tony today (by phone, email or Calendly) to arrange for a “no obligation” conversation or meeting with you and your family

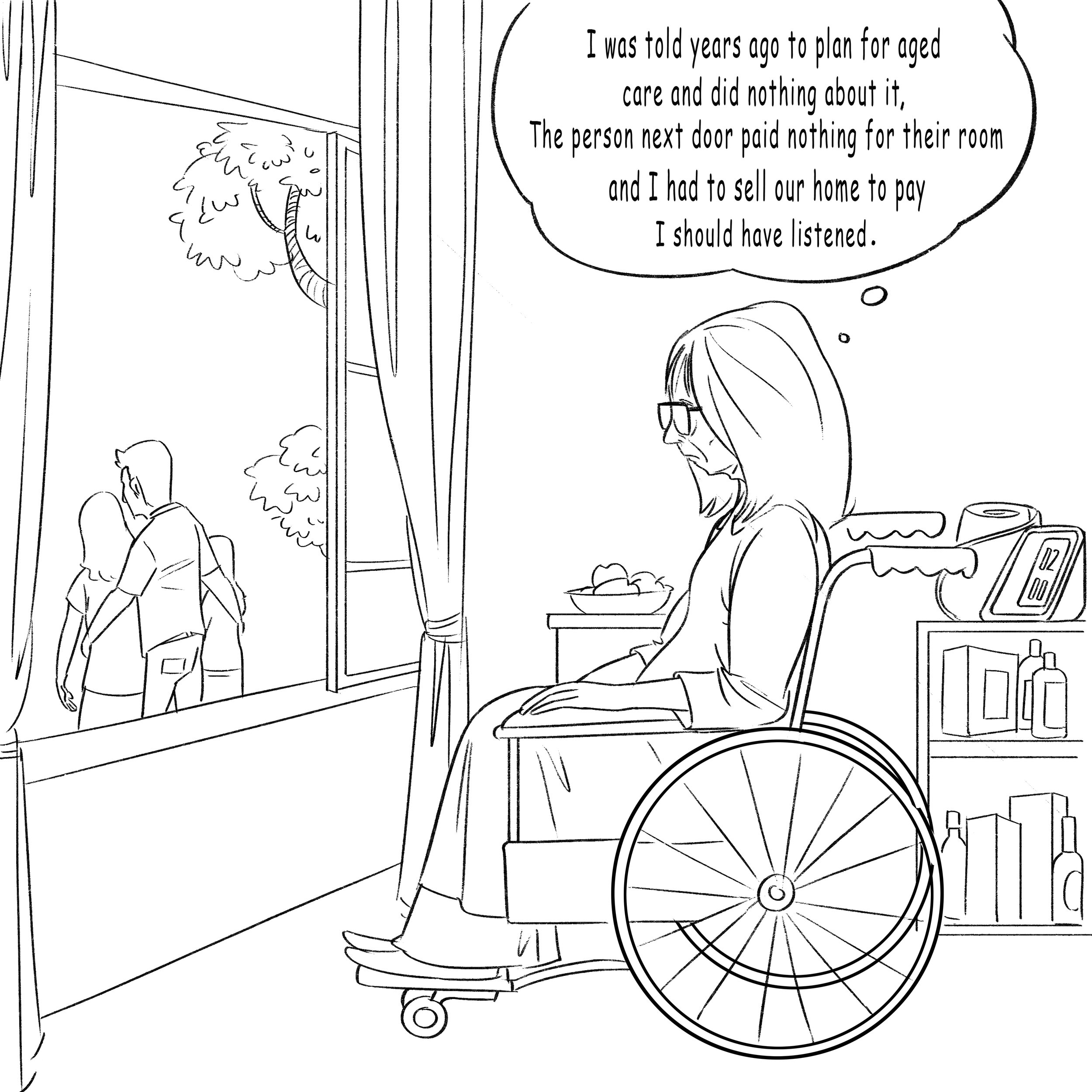

House lost to pay for Aged Care

Breanna was asked to pay $550,000 for the room in aged care, as her assets were more than $172,000. She did not have this sort of money, and had not previously planned for possible aged care entry. Another family meeting and Breana’s home of 45 years was sold to pay for her room. The family were disappointed as they knew that Mum had always wanted to pass on the home to them when she had passed on and this wasn’t going to happen.

A couple who planned for Aged Care Entry

Sadly, Marj suffered a severe stroke after a fall at home some fourteen months later and was admitted to an aged care facility, as Ron was now unable to fully care for Marj. As they had already implemented one of the options provided to them by EPACES they were now financially in a safe place. The chosen option had utilised some of the Centrelink rules meaning Ron and Marj were not asked to pay for Marj’s room in aged care, they were surprised that their friends had been right as other residents in the same place had paid up to $550,000 for a similar room. Centrelink also increased their pensions as they were separated due to illness.

Pension & Estate wishes affected by Aged Care

Elizabeth’s is 85, a single pensioner with severe dementia, her home was sold for over $900,000, and a RAD (refundable accommodation deposit) of $490,000 was paid to the facility for Elizabeth’s room. As Elizabeth no longer had a house, part of the sale proceeds, other assets plus deemed income put her over the maximum allowable pension limits, and her pension was subsequently cancelled by Centrelink.